What is Usage Based Insurance?

Usage Based Insurance, or UBI, is defined by the National Association of Insurance Commissioners as a type of auto insurance that tracks mileage and driving behaviors. They further explain that the basic idea of UBI is that a driver’s behavior is monitored directly while the person drives, allowing insurers to more closely align driving behaviors with premium rates.

How UBI Works

Underwriters can now consider factors that formerly were not available. Total miles driven, time of day, geographic location, and road type all speak to driving conditions and insurance liability. Speed, rapid acceleration, hard braking, and hard cornering are behaviors known to directly impact accident risk. Obviously actual automobile usage is a more accurate method to assess risk than the actuarial methods in use. Actuarial methods aggregate accident risk based on age, gender, marital status, credit score, and driving history. Consequently UBI is a much fairer way to assign risk and set insurance premiums.

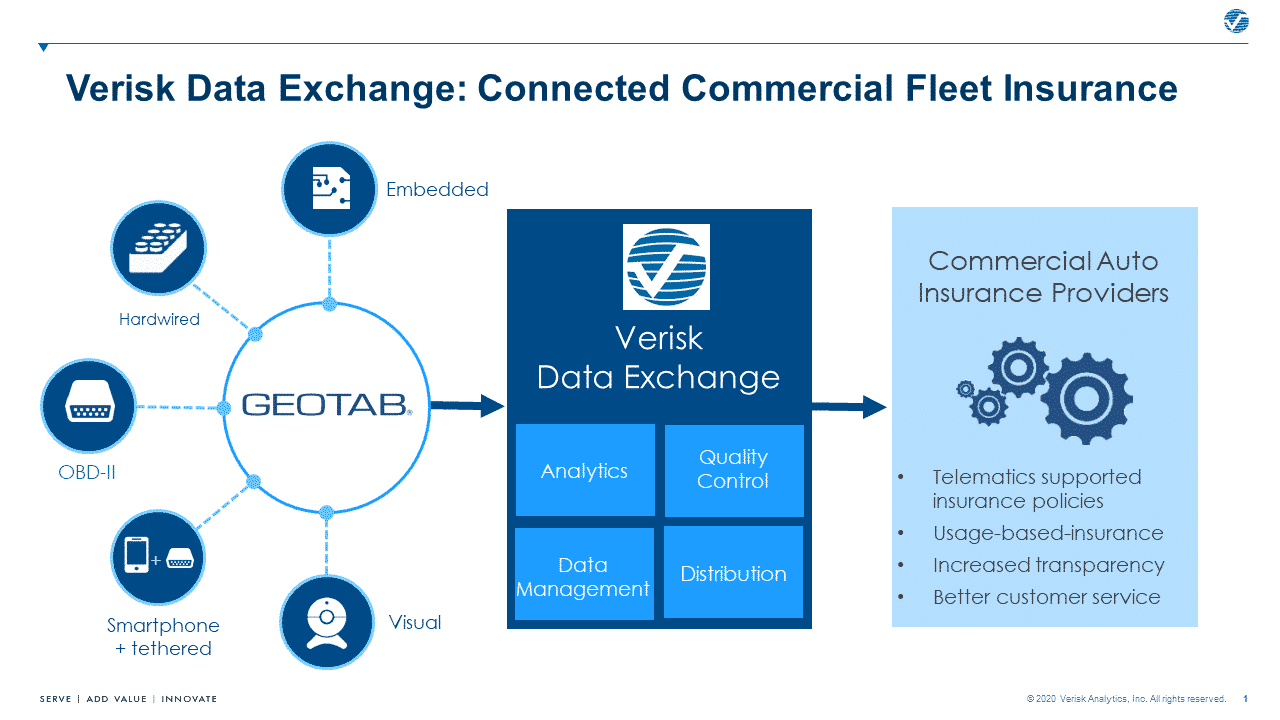

In response, telematics vendors are developing more tools to evaluate at risk driving. For example, the free Verisk Data Exchange add-in was recently introduced to the Geotab Marketplace. It is a platform that allows both customers and their insurers to access the same smart analytics that impact insurance premiums.

Telematics is the Key to UBI

Advanced telematics is what makes Usage Based Insurance possible. Over the years, telematics providers and their partners have proven the value of telematics data. The information at our fingertips identifies risky driving behaviors. More important, we can use it to improve and correct them with driver training. In contrast, not acting on the information we have increases liability. But that is easily corrected as shown in the video below. Clearly the benefits that make companies more efficient and competitive outweigh any concerns over increased liability. Usage Based Insurance rates are another potential cost savings to add to that return on investment.

Usage Based Insurance Drives Driver Improvement

Improving driver behavior based on telematics data is easy to automate. Apps like Predictive Coach do all of the heavy lifting. There are also traditional courses like the National Safety Council Defensive Driving Course. A combination of ongoing and individually targeted training raises driver safety awareness and creates a culture of safety. Doing that will more than pay for itself in the long run, not to mention reducing your company liability. Proactive training increases the opportunity to reduce insurance premiums with new and innovative insurance plans like Usage Based Insurance. Ultimately the incentive to improve driving behavior for lower insurance rates will drive the success of initiatives like Vision Zero, making the roads safer for us all.

What the Future Holds

In conclusion, Transport Topics recently stated rising insurance premiums are a perennial stress for many motor carriers, many of which are now installing telematics systems with the latest safety technologies to mitigate cost increases. This is a positive trend for the trucking industry, and more carriers should fully embrace these technologies as they soon will become necessary to operate a safe, efficient and, ultimately, more profitable trucking fleet.